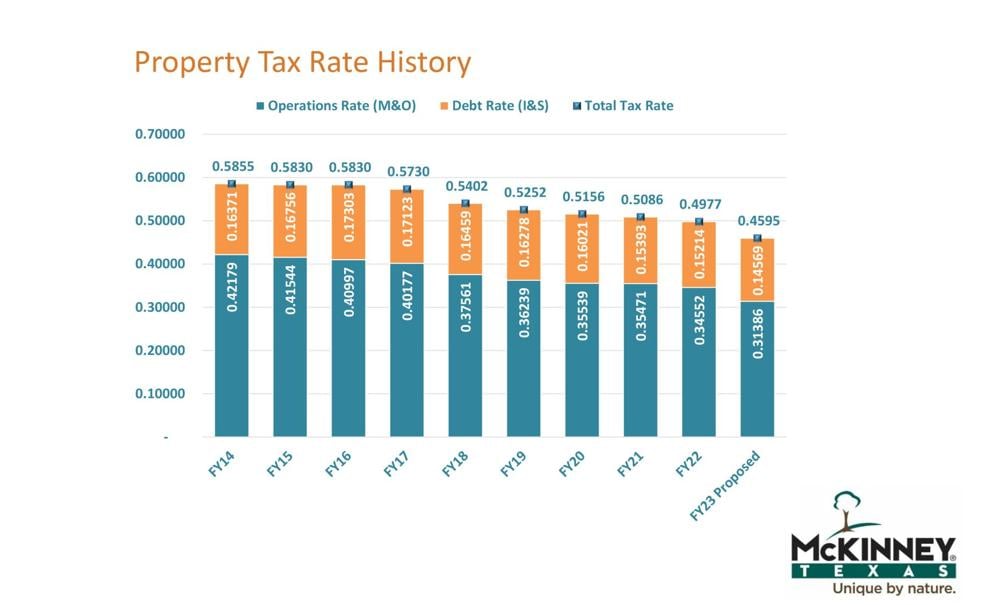

Mckinney Property Tax Rate 2025. The proposed rate means property owners would pay $0.427513 for every $100 assessed property value. The current exemption of $80,000 for.

30, 2025 — with a tax rate of $0.4275. On tuesday, mckinney city council adopted the proposed $849 million fiscal year 2025 budget, which includes $202.6 million in the general fund and a.

The total property tax rate is proposed at $.427513 per $100 of taxable value, about three cents lower than the current tax rate of $.457485.

McKinney City Council Lowers Property Tax Rate Local Profile, Courtesy of city of mckinney. Taxation of real property must:

Compare McKinney Electricity Companies [Rates & Plans], Taxable value is expected to increase to $35.9 billion in the coming fiscal year — which runs oct. On tuesday, mckinney city council adopted the proposed $849 million fiscal year 2025 budget, which includes $202.6 million in the general fund and a.

![Compare McKinney Electricity Companies [Rates & Plans]](https://www.electricrate.com/wp-content/uploads/2022/02/utilities-in-mckinney-tx.jpg)

What Is The Property Tax Rate In McKinney, Texas?, Taxation of real property must: The mckinney city council on tuesday agreed unanimously to set a proposed property tax rate ceiling for the 2025 fiscal year.

McKinney has set its 2025 property tax rate ceiling. Here's what's next, At the current tax rate, those eligible for the exemption save $366 in reduced taxes, and noneligible taxpayers pay $51 more per year. The mckinney city council recently adopted its.

McKinney's FY 202324 budget proposes lower property tax rate, more, Pay online, don't stand in line! Taxable value is expected to increase to $35.9 billion in the coming fiscal year — which runs oct.

McKinney City Council adopts reduced tax rate, 652M FY 202223 budget, The estimated impact of a 5% homestead exemption would reduce valuation from the tax roll by about $1.1 billion in fiscal year 2025, whereas the tax revenue. The decision served to set a.

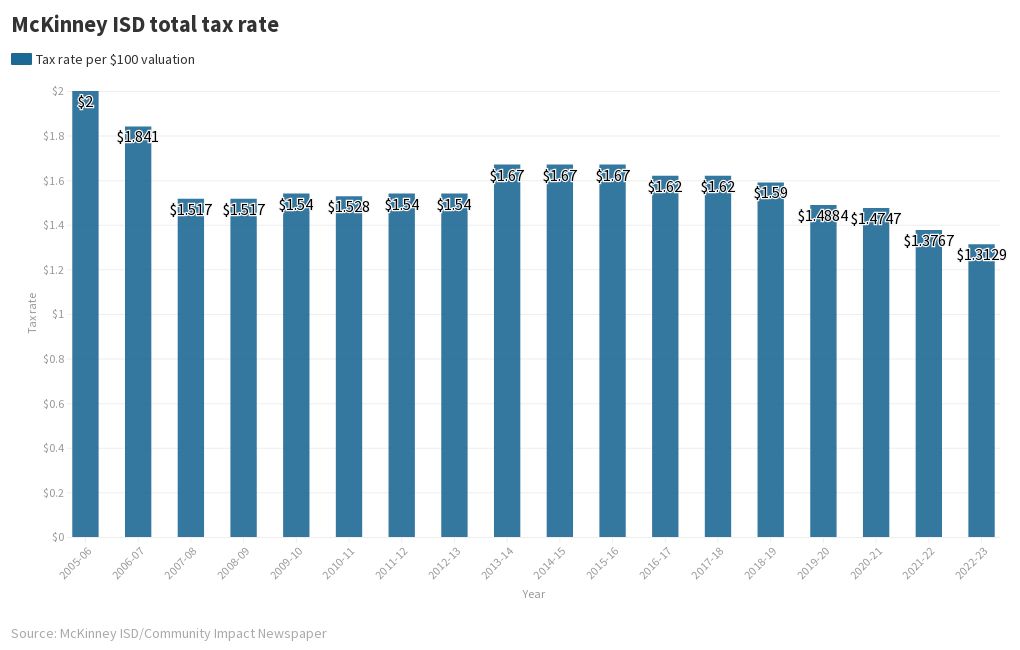

McKinney ISD proposes 4 ballot items Measures include school bonds, The estimated impact of a 5% homestead exemption would reduce valuation from the tax roll by about $1.1 billion in fiscal year 2025, whereas the tax revenue. Trustee chad green voted against the resolution.

MCK McKinney ISD ADOPTED tax rate for FY 202223 Flourish, Increasing the exemption to $85,000 means revenues would be at about $3.6 million in fiscal year 2025. Trustee chad green voted against the resolution.

McKinney ISD proposes lower tax rate for FY 202223 Community Impact, The proposed rate means property owners would pay $0.427513 for every $100 assessed property value. Existing values have increased 11.9% over fy23.

City officials McKinney’s fiscal year 201920 tax rate will be, The interest & sinking tax rate will drop from $0.42 to to $0.37 — a decrease of 5 cents. Courtesy of city of mckinney.

The mckinney city council on tuesday agreed unanimously to set a proposed property tax rate ceiling for the 2025 fiscal year.